When

you read or hear news stories about the total amount of taxes you pay,

the number can seem unreasonably high until you account for payroll

(federal, state, local), standard point-of-sale (state, local), special

PoS (cigarette, gas, appliance disposal), utilities (electric, phone,

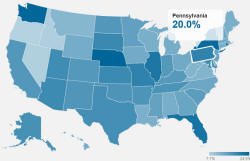

heating fuel, water), and multitudinous other hidden taxes. Per CNN

today: "Your wireless carrier isn't the only one pocketing money when

you pay your cell phone bill. Local, state and federal governments,

911 systems and even school districts tack on taxes and surcharges to

your wireless bill that end up costing American cell phone customers

an extra 17.2%, on average, according to the Tax Foundation. That's

up from 16.3% fifteen months ago." When

you read or hear news stories about the total amount of taxes you pay,

the number can seem unreasonably high until you account for payroll

(federal, state, local), standard point-of-sale (state, local), special

PoS (cigarette, gas, appliance disposal), utilities (electric, phone,

heating fuel, water), and multitudinous other hidden taxes. Per CNN

today: "Your wireless carrier isn't the only one pocketing money when

you pay your cell phone bill. Local, state and federal governments,

911 systems and even school districts tack on taxes and surcharges to

your wireless bill that end up costing American cell phone customers

an extra 17.2%, on average, according to the Tax Foundation. That's

up from 16.3% fifteen months ago."My home state of Pennsylvania

reportedly has a tax rate of 20%. I only use a prepaid TracFone that

costs about $64 (including sales tax) and give 1,000 minutes. After

three years of use and refilling the card (twice), there are still more

than 2,500 minutes left - that's how little I use a cellphone. It is

only turned on during long road trips. If it weren't for being able

to track my credit card purchases and Internet usage, the Fed would

know very little about my personal habits. Well, I suppose they can

get my 2011 Jeep Patriot computer record, too.

Posted 7/10/2013

|