|

January 1, 1960 Electronics

[Table of Contents] [Table of Contents]

Wax nostalgic about and learn from the history of early electronics.

See articles from Electronics,

published 1930 - 1988. All copyrights hereby acknowledged.

|

If I had the time, it would be

interesting to research how accurate this Electronic Market prediction from the

January issue of Electronics magazine compares to how the decade actually ended.

My guess based on most of the history of the electronics industry is that except

for very fantastic prognostications of personal nuclear power sources and

domestic robots in every household, the forecasts greatly underestimated actual

progress. That is because discoveries are made so frequently and improvements

made so quickly that after ten years there are innumerable new aspects of

electronics that were never even dreamed of a decade earlier. According to one

source, the

consumer electronics market in 2020 was close to $700B, as compared to $1.6B

in 1959. Adjusting for inflation, that $1.6B is the equivalent of about $14B in

2020, so the market growth for consumer electronics in that time period was

around 50x ($700B/$14B). That is a significant increase in just one sector of

the electronics industry. Assuming 40% of FY2020, $718B U.S. defense budget went

to electronics (per

MAE), that $287B ($32B

in 1959 money) represents a $32B/$6.3B = 5x growth over the same time period

(surprisingly small, really). So, what to make over this? Don't ask me; I don't

know.

Forecast is for increased sales in every major category with military

sales leading the way. Industrial and commercial sales are rising fast.

By Edward de Jongh, By Edward de Jongh,

Market Research

Editor

Thomas Emma,

Associate Editor

Howard K. Janis,

Associate Editor

Our Market

The Manpower Picture

The Electronics Market Market

Research Tables

Buying and Selling Abroad

Getting Goods to Market

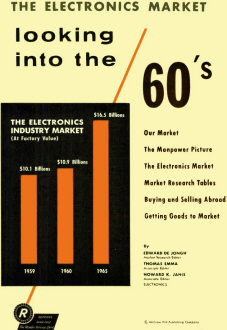

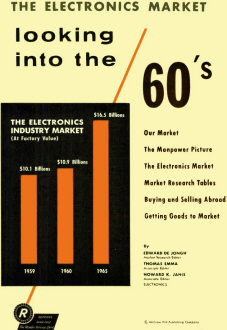

Electronics Industry sales of end equipment and replacement parts at factory

door prices should near $11 billion this year. By 1965, sales should rise above

$16 billion.

Last year's sales topped $10 billion for the first time. This mark was an 11-percent

gain over 1958 sales. The bright sales outlook reflects recovery from the 1957-1958

recession and a pickup in military spending for electronics.

Expanding business activity expected throughout the sixties, rising population

totals, continued high military and government spending support these predictions.

That's the summary of ELECTRONICS' latest yearend market forecast. Sales of all

major segments of the industry are participating in the predicted sales growth.

Electronics dollar export totals, equivalent to four percent of total industry

sales, registered only a moderate sales gain in 1959 over 1958, although export

sales of some specific industrial products fared better.

Imports are up. Estimated electronics imports to U. S. of $120 million in 1959

were more than twice the 1958 figure. More than half the 1959 total came from Japan.

Rising import totals could lead to a negative electronics foreign trade balance

in the future.

Growth of electronics markets is paralleled by growing manufacturers' interest

in methods of distributing products.

ELECTRONICS finds manufacturers are reexamining their distribution methods and

asking such questions as: Are we using the most effective channels of distribution?

How can we help to improve existing channels? An increasing number of manufacturers

are working closely with electronics manufacturers' representatives and distributors.

Military Electronics

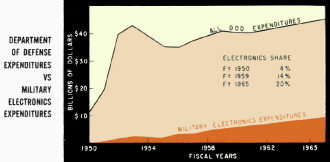

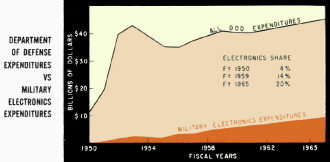

Moderately rising Department of Defense budgets over the next five years, coupled

with increasing dependence of the armed services on electronic techniques and equipment,

mean more electronics business for many years to come.

Between 1950 and 1959 our share of DOD spending rose from four to 14 percent.

By 1965 it will be 20 percent, as shown in the chart of DOD and military electronics

expenditures.

Military customers were the source of 58 percent of all electronics sales last

year, taking $5.9 billion worth of electronic equipment and parts. In 1960 military

sales are expected to reach $6.3 billion.

Expected military sales of $9.8 billion in 1965 is almost equal to total industry

sales today.

Swing to manufacture of missiles in production quantities is an important reason

for high military electronics spending in 1959 and 1960.

Missile expenditures of $1.481 billion in 1959 are about thirty percent higher

than 1958. Another substantial increase is looked for in 1960 which will boost the

missile expenditure total to $1.7 billion.

Rise in missile spending has more than offset

a drop in aircraft electronics, expected to fall to $1.5 billion in 1960 from $1.7

billion in 1958 and 1959. Rise in missile spending has more than offset

a drop in aircraft electronics, expected to fall to $1.5 billion in 1960 from $1.7

billion in 1958 and 1959.

Electronics communications expenditures, backbone of much military air defense

system procurement, are becoming a substantial part of the defense business.

By 1960, electronic communications expenditures will reach almost $1 billion

and will represent 22 percent of military spending for electronics production procurement.

Few areas of the electronics industry are growing faster than research, development,

test and evaluation.

In 1959-1960, sales will jump 36 percent. Estimate for 1960 is one billion dollars

as against $733 million in 1958.

The RDT&E budget category was initiated by the government last year. It combines

the previous research and development category with expenditures for equipment in

test and evaluation and not yet in quantity production.

Missiles and space equipment are presently getting most of the RDT&E money.

Missiles and astronautics got over $1.5 billion of $3.8 billion worth of total new

obligational authority for fiscal 1960.

Increasing amount and complexity of electronic equipment used by the armed services

is boosting spending in the operation and maintenance budget category.

The O&M category covers repair and overhaul of military equipment. The electronics

part of that budget category is expected to be $890 million in 1959. Prediction

for 1960 is $950 million.

Over the next five years spending for space exploration and for air traffic control

equipment will play increasing roles in the electronics business. Although not wholly

for military purposes, these expenditures are included here because of the difficulty

of separation.

National Aeronautics & Space Administration and Federal Aviation Agency,

in combination are expected to spend about $900 million in 1960 and about $2 billion

in 1965. Electronics portion is currently estimated at one third and is rising.

Figures do not include DOD spending for space, currently running at near $350 million.

This sum is split between the RDT&E and missile electronics categories.

Other military growth markets over the coming five-year period are infrared,

point-to-point microwave communications equipment and antisubmarine warfare (ASW)

equipment.

By 1965 the infrared market is expected to grow from current $110-million level

to $425 million. Over the same period a four-fold growth in point-to-point microwave

expenditures from present $50-million figure is anticipated.

Estimate of the ASW market have not jelled. Current spending is in excess of

$132 million a year. In the past five years sales grew from almost insignificant

levels.

Consumer Electronics

This oldest segment of the electronics business enjoyed a major rally in 1959.

Last year's sales of $1.6 billion were 21 percent ahead of 1958, largely influenced

by improving business conditions, higher automobile sales and depleted retailer

and distributor inventories.

The steel strike resulted in lower levels of entertainment set sales than anticipated

in the last two months of 1959, particularly auto radio. But it had only a minor

effect on total consumer electronics sales for the year. Moreover, steel strike

sales losses should mean greater gains in 1960.

Forecast for 1960 is for a continued high level of consumer business with a gain

of about five percent, which will bring total consumer sales to almost $900 million.

Bulk of gains in consumer product sales are accounted for by tv sets, radio sets

and phonographs.

Tv set sales of $853 million in 1959 were 19 percent ahead of 1958 and are scheduled

for a five-percent increase in 1959. Radio set sales of $378 million last year were

23 percent ahead of 1959 and are headed for $425 million in 1960. Phonographs with

$190 million in sales in 1959 were 20 percent ahead of the preceding year.

Behind the improved black and white tv set business are increases in the number

of second and third set homes; annual growth in number of homes wired for electricity

and improved business conditions.

Color sets continue as a minor part of tv set total sales. Estimates of sales

growth vary from 10 to 25 percent annually. But actual sales figures are not available.

Encouraging factor is that three manufacturers now actively pursuing the color set

market report rapidly rising sales.

By 1965 table portable tv sets and battery-powered transistorized models may

dominate the black and white tv sales picture. Color tv could boom by then. Improvements

in radio programs, which have led to greater consumer interest in radio listening

and purchasing, plus big increase in portable sales are major factors behind radio

set sales growth.

Growth trend is expected to continue over

the next five years with sales rising steadily through 1965. Manufacturers are talking

about selling a radio for every room in the house by 1965. Radio set merchandisers

say that the trend among consumers to purchase radio sets as an impulse or gift

item supports this expectation of future sales. Growth trend is expected to continue over

the next five years with sales rising steadily through 1965. Manufacturers are talking

about selling a radio for every room in the house by 1965. Radio set merchandisers

say that the trend among consumers to purchase radio sets as an impulse or gift

item supports this expectation of future sales.

Rapid consumer acceptance of packaged hi-fi and stereo phonographs is a force

behind phonograph sales growth.

Electronic organs and other consumer electronics equipment such as garage door

openers, toys, headlight dimmers and kitchen devices accounted only for $74 million

of sales in 1959. But rising consumer incomes are expected to build demand for these

items considerably in the coming five years. Estimated sales for this group of $93

million in 1960 is 25 percent ahead of 1959.

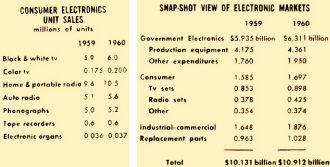

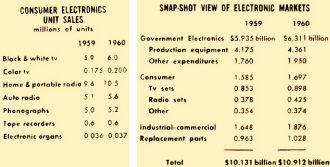

Tabulation of unit sales of consumer equipment is shown in the table (next page,

left).

Industrial Electronics

In the past industrial electronics has been a sleeping giant. Holding the potential

for tremendous sales increases, the industrial category has thus far demonstrated

greater potential for publicity than sales growth.

However, rapidly rising research and development expenditures, need to modernize

industrial plants, necessity of meeting foreign competition by lowering production

costs - all point to wider use of electronics equipment by industry.

Growing acceptance of electronics equipment by industrial customers is another

major factor in the improving prospects for industrial electronics business. In

many product areas such as data processing, testing and measuring and communications

equipment, the job of winning acceptance has largely been won. Electronics industry

manufacturers are now striving for acceptance of integrated industrial electronic

systems. Progress in winning system acceptance is expected to be a major factor

in development of industrial electronics sales through the sixties.

ELECTRONICS estimates industrial and commercial electronics sales at $1.65 billion

in 1959, a 14-percent increase over 1958. Another 14-percent sales increase in 1960

will bring the sales total to $1.9 billion.

Estimated 1965 sales of $3 billion are based on a conservatively estimated 10-percent

annual sales growth. Some observers are predicting a 12 to 14- percent growth rate

during the period. Many manufacturers say that the electronics industry's greatest

growth potential is in the field of industrial electronics business.

Big factors in industrial sales are electronic data processing equipment (EDP),

test and measuring equipment and industrial controls.

EDP sales should reach almost a billion dollars by 1965. Sales forecasts for

1959 and 1960 are $350 million and $415 million respectively.

Test and measuring instruments, closely related to spending on research and development

are estimated at $275 million in 1959 and $310 million in 1960.

By 1960 industrial controls should register at least $200 million, an average

increase of 12 percent over the preceding two years.

Other industrial products worth watching are air navigation, point-to-point microwave

communications, land-mobile communications and nuclear electronics equipment.

Replacement Parts

Estimate for 1959 replacement parts sales is $963 million, a six-percent advance

over 1958. In 1960 sales total should top $1 billion. Continuation of average growth

rate will produce sales of replacement parts of $1.5 billion by 1965.

A cloud in the replacement parts business picture is the trend to transistorization,

which could eventually curtail consumer spending on replacement parts.

Components Sales

Total components sales, including sales

of both replacement parts and parts used with initial equipment, are of far greater

interest to electronics manufacturers than replacement components sales. Total components sales, including sales

of both replacement parts and parts used with initial equipment, are of far greater

interest to electronics manufacturers than replacement components sales.

The components business experienced the benefits of increased military spending

for electronics and generally healthy business conditions during 1959. Military

demand for components with greater reliability plus ability to operate under extreme

environmental conditions, which had a healthy influence on components sales last

year, in continuing.

Tubes are big business in electronic components. Total sales last year of $825

million were 13 percent ahead of 1988.

Anticipated sales increases of 17 percent in 1959 and 15 percent in 1960 are

expected to bring total power and special purpose tubes sales to $288 million in

1960. Military demand for microwave tubes is a big factor, with klystrons and travelling

wave tubes doing particularly well.

Predicted semiconductor sales in 1959 of $445 million are 89 percent ahead of

1958. Another 40-percent sales jump is anticipated in 1960.

Transistor sales of $250 million in 1959 exceed 1958 by 121 percent. Sales gain

for 1960 is conservatively estimated at 50 percent.

Silicon transistor share of total transistor sales was estimated at $80 million

for 1959. Silicon share is expected to increase to $130 million in 1960, one third

of total forecasted transistor sales.

Trend towards transistorization of electronic consumer and industrial equipment,

plus increasing specification of transistor components in military equipment contracts,

are behind transistor and semiconductor sales growth.

Practically all other broad categories of electronic components are growing at

a lively rate.

Last year saw capacitors and resistors snap back from the sales declines they

experienced in 1958. Dollar sales totals of both for 1959 are expected to be 20

percent or more ahead of 1958 and further sales advances are expected in 1960.

Table (above, right) lists estimated 1959 and 1960 sales of major components.

Posted August 19, 2022

|