Press Release Archives:

2026 | 2025 |

2024 |

2023 |

2022

2021 |

2020 |

2019 |2018 | 2017 | 2016 |

2015

Content is copyright of company represented. Page format, custom text and

images are RF Cafe copyright - do not distribute. Note: Posting of press releases costs $100 each for non-advertisers.

Sam Benzacar of

Anatech Electronics, an RF and microwave filter company, has published his November

newsletter that features his short op-ed titled "My Predictions for 2019: The

Reckoning," which is a follow-up on his December 2018 newsletter main article entitled,

"," that included 5G, IoT, Defense, and rural broadband. Buried within this year's

"reckoning" are a few predictions for 2020. Will Sam be as prescient regarding 2020

as he was for 2019? Check in this time next year to find out. In other news, Sam

includes a few other items related to our RF industry.

A Word from Sam Benzacar

My Predictions for 2019: The Reckoning

By Sam Benzacar By Sam Benzacar

Last December, instead of summing up the trends to watch in the coming year,

I took the precarious step of making my own predictions. For example, I predicted

that 5G-capable smartphones would be available from some manufacturers and Fixed

Wireless Access [FWA] (wireless broadband delivery) would be available in some places.

Both proved to be true, although only a few 5G-enabled smartphones are available

a year later and Apple is waiting until later this year or possibly next year.

The big news this year has been rollouts of FWA by Verizon at 28 GHz and

AT&T using a combination of millimeter-wave and mid-band frequencies. T-Mobile

is taking the low road, using mid-band frequencies exclusively, although millimeter-wave

frequencies could be added if the merger with Sprint is achieved. FWA represents

the leading of 5G at the moment.

5G: FWA will expand to become

a true competitor to cable as it's deployed more widely in urban and some suburban

areas. Now that the stand-alone version of 5G New Radio (5G NR) has been finalized,

5G deployment, in general, will accelerate in 2020, more Android smartphones will

become available, and prices may decrease along with greater competition. Apple,

which typically follows its own path, may (or may not) add some 5G capabilities

to its phone line-up in the third or fourth quarter. 5G: FWA will expand to become

a true competitor to cable as it's deployed more widely in urban and some suburban

areas. Now that the stand-alone version of 5G New Radio (5G NR) has been finalized,

5G deployment, in general, will accelerate in 2020, more Android smartphones will

become available, and prices may decrease along with greater competition. Apple,

which typically follows its own path, may (or may not) add some 5G capabilities

to its phone line-up in the third or fourth quarter.

Realistic service plans will begin to appear from the big four (or three) carriers

later in the year. Deployment of millimeter-wave infrastructure will increase, and

it will be somewhat easier to visualize how well it will work to ensure low-latency,

gigabit-per-second downlink speeds, and coverage indoors and other difficult coverage

areas.

New Mid-Band Spectrum: Unlike almost everywhere else, the U.S.

has few available spectrum resources below 6 GHz, but the FCC is feverishly

working to remedy this through re-farming of existing services, frequency sharing,

the Citizens Broadband Radio Service (CBRS), and other efforts. We can expect the

issues surrounding these activities to produce beneficial results for carriers,

allowing them to provide some 5G requirements without the immediate need to rely

on millimeter-wave frequencies.

IoT: In the consumer world, IoT has become a standard feature

in everything from home automation to surveillance, digital assistants, and many

other products. In 2020, some of the kinks will be removed, such as problems with

incompatibility among short-range communication standards using multi-protocol IoT

gateways. The much larger industrial markets such as industrial IoT and "smart"

cities will ramp up significantly this year and new applications will begin to be

deployed as well.

Rural Broadband: The wireless industry will finally step up

to the plate to minimize the number of people with either minimal or no broadband

service. All it took was the possibility of significant revenue generated by broadband,

IoT, and in the case of AT&T the windfall provided by the National Broadband

Public Safety Network. It's great news for customers but probably bad news for the

wireless internet service provider (WISP) industry that has been the saving grace

for rural customers for two decades.

Defense: I predicted that 2019 would be a great year for RF

and microwave manufacturers serving the defense industry. Just how accurate this

prediction was depended, as always, on what programs you serve. In 2020, I predict

that revenue will increase more broadly as services upgrade their equipment, and

the Army in particular, is massively expanding its EW capabilities. There are many

other potentially lucrative programs, from satellites to GPS, and new Navy ships,

to name just a few.

There are obviously many other markets that contribute to the total revenue of

the industry, but those above are those driving most of its fortunes. We'll check

back this time next year to see how my predictions fared.

In the meantime, all of us at Anatech Electronics wish everyone the best for

a wonderful holiday season, and good health, happiness, and prosperity for the New

Year!

Verizon Steps up 5G Home Offering

Verizon's 5G Home fixed

wireless access (FWA) service is about to transition from its "pre-standardized

version to 5G New Radio (NR), first in Chicago with other cities soon to follow,

according to the company. The customer-premise unit now includes a router that supports

Wi-Fi 6 (formerly known as IEEE 802.11ax) that also includes Bluetooth playback

and parental controls, and Amazon Alexa. It includes a smartphone app that helps

customers position the equipment in the home to make it self-installable. It costs

$50 per month for Verizon customers and $70 otherwise and offers downlink speeds

of 300 Mb/s to 1 Gb/s. Verizon says the next step will be to allow 5G (i.e., cellular)

signals to be available in the home, using repeaters. Verizon's 5G Home fixed

wireless access (FWA) service is about to transition from its "pre-standardized

version to 5G New Radio (NR), first in Chicago with other cities soon to follow,

according to the company. The customer-premise unit now includes a router that supports

Wi-Fi 6 (formerly known as IEEE 802.11ax) that also includes Bluetooth playback

and parental controls, and Amazon Alexa. It includes a smartphone app that helps

customers position the equipment in the home to make it self-installable. It costs

$50 per month for Verizon customers and $70 otherwise and offers downlink speeds

of 300 Mb/s to 1 Gb/s. Verizon says the next step will be to allow 5G (i.e., cellular)

signals to be available in the home, using repeaters.

5G SoC Market to Hit $10.9 Billion in 2024

Common Networks, a company

founded by ex-Square employees, has designed a technology that can challenge providers

in the telecommunications market. For about $50 a month, Common Networks is offering

300 Mb/s too 1Gb/s download speeds for households around Silicon Valley. The company

uses unlicensed 5G microwave and millimeter-wave spectrum an antennas installed

on rooftops, and using open-source software and hardware, the company developed

so "graph-based technology" that delivers high-speed broadband for what it claims

is about one-tenth what telecom companies typically pay. Common Networks, a company

founded by ex-Square employees, has designed a technology that can challenge providers

in the telecommunications market. For about $50 a month, Common Networks is offering

300 Mb/s too 1Gb/s download speeds for households around Silicon Valley. The company

uses unlicensed 5G microwave and millimeter-wave spectrum an antennas installed

on rooftops, and using open-source software and hardware, the company developed

so "graph-based technology" that delivers high-speed broadband for what it claims

is about one-tenth what telecom companies typically pay.

FBI: Use Separate Wi-Fi Networks for IoT

The FBI's Portland, OR,

office says home IoT devices like doorbells, digital assistants, and other devices

should be on a Wi-Fi network separate from computers. "Your fridge and your laptop

should not be on the same network," the office said in its weekly advice column.

"Keep your most private, sensitive data on a separate system from your other IoT

devices." Its good advice considering that IoT devices have dubious security features

now, and camera-enabled doorbells are being integrated into neighborhood networks

used by law enforcement. The reasoning behind it is simple. By keeping all the IoT

equipment on a separate network, any compromise of a "smart" device will not grant

an attacker a direct route to a user's primary devices -- where most of their data

is stored. Jumping across the two networks would require considerable effort from

the attacker. The easiest way is to use two routers. The same advice has been shared

in the past by IT and security experts. The FBI's Portland, OR,

office says home IoT devices like doorbells, digital assistants, and other devices

should be on a Wi-Fi network separate from computers. "Your fridge and your laptop

should not be on the same network," the office said in its weekly advice column.

"Keep your most private, sensitive data on a separate system from your other IoT

devices." Its good advice considering that IoT devices have dubious security features

now, and camera-enabled doorbells are being integrated into neighborhood networks

used by law enforcement. The reasoning behind it is simple. By keeping all the IoT

equipment on a separate network, any compromise of a "smart" device will not grant

an attacker a direct route to a user's primary devices -- where most of their data

is stored. Jumping across the two networks would require considerable effort from

the attacker. The easiest way is to use two routers. The same advice has been shared

in the past by IT and security experts.

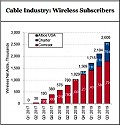

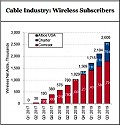

Cable Moves into the Mobile Market

Major cable companies are

moving into the wireless business at a surprisingly rapid pace. In the third quarter

of this year alone, Comcast, Charter, and Altice added nearly 500,000 subscribers,

collectively reaching 2.5 million. MoffettNathanson analyst Craig Moffett noted

in a recent report that "as a percentage of net market growth, the cable operators

have already reached a level of clear relevance in wireless," and that cable is

now starting to "matter" in the wireless sector. He expects cable companies to add

nearly 2 million subscribers in 2020. Pricing is one of the reasons as Altice, for

example, is offering its current broadband subscribers at a rate of $20 per month

per line "for life" with unlimited voice, text, and data. Major cable companies are

moving into the wireless business at a surprisingly rapid pace. In the third quarter

of this year alone, Comcast, Charter, and Altice added nearly 500,000 subscribers,

collectively reaching 2.5 million. MoffettNathanson analyst Craig Moffett noted

in a recent report that "as a percentage of net market growth, the cable operators

have already reached a level of clear relevance in wireless," and that cable is

now starting to "matter" in the wireless sector. He expects cable companies to add

nearly 2 million subscribers in 2020. Pricing is one of the reasons as Altice, for

example, is offering its current broadband subscribers at a rate of $20 per month

per line "for life" with unlimited voice, text, and data.

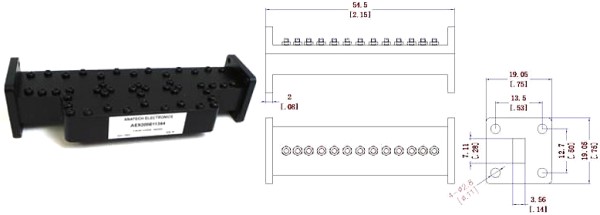

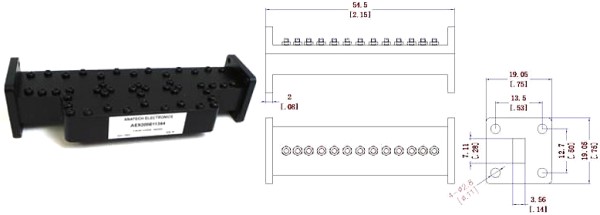

Getting Ready for 5G:

Anatech Electronics introduce New Ka band 30.5 GHz Waveguide Band Pass Filter.

Featuring a center frequency of 30.5 GHz, a bandwidth of 1000 MHz, an Insertion

Loss 1 dB Max, and a Power Handling is 20 watts.

Anatech Electronics Introduces a New Line of Suspended

Stripline and Waveguide Type RF Filters

Check out Our Filter Products

Cavity Band Pass Filters

LC Band Pass Filters Cavity Bandstop/Notch Filter

About Anatech Electronics

Anatech Electronics, Inc. (AEI) specializes in the design and manufacture of

standard and custom RF and microwave filters and other passive components and subsystems

employed in commercial, industrial, and aerospace and applications. Products are

available from an operating frequency range of 10 kHz to 30 GHz and include cavity,

ceramic, crystal, LC, and surface acoustic wave (SAW), as well as power combiners/dividers,

duplexers and diplexers, directional couplers, terminations, attenuators, circulators,

EMI filters, and lightning arrestors. The company's custom products and capabilities

are available at www.anatechelectronics.com.

Contact:

Anatech Electronics, Inc.

70 Outwater Lane

Garfield, NJ 07026

(973) 772-4242

sales@anatechelectronics.com

Posted December 17, 2019

|

By Sam Benzacar

By Sam Benzacar 5G: FWA will expand to become

a true competitor to cable as it's deployed more widely in urban and some suburban

areas. Now that the stand-alone version of 5G New Radio (5G NR) has been finalized,

5G deployment, in general, will accelerate in 2020, more Android smartphones will

become available, and prices may decrease along with greater competition. Apple,

which typically follows its own path, may (or may not) add some 5G capabilities

to its phone line-up in the third or fourth quarter.

5G: FWA will expand to become

a true competitor to cable as it's deployed more widely in urban and some suburban

areas. Now that the stand-alone version of 5G New Radio (5G NR) has been finalized,

5G deployment, in general, will accelerate in 2020, more Android smartphones will

become available, and prices may decrease along with greater competition. Apple,

which typically follows its own path, may (or may not) add some 5G capabilities

to its phone line-up in the third or fourth quarter.  Verizon's 5G Home fixed

wireless access (FWA) service is about to transition from its "pre-standardized

version to 5G New Radio (NR), first in Chicago with other cities soon to follow,

according to the company. The customer-premise unit now includes a router that supports

Wi-Fi 6 (formerly known as IEEE 802.11ax) that also includes Bluetooth playback

and parental controls, and Amazon Alexa. It includes a smartphone app that helps

customers position the equipment in the home to make it self-installable. It costs

$50 per month for Verizon customers and $70 otherwise and offers downlink speeds

of 300 Mb/s to 1 Gb/s. Verizon says the next step will be to allow 5G (i.e., cellular)

signals to be available in the home, using repeaters.

Verizon's 5G Home fixed

wireless access (FWA) service is about to transition from its "pre-standardized

version to 5G New Radio (NR), first in Chicago with other cities soon to follow,

according to the company. The customer-premise unit now includes a router that supports

Wi-Fi 6 (formerly known as IEEE 802.11ax) that also includes Bluetooth playback

and parental controls, and Amazon Alexa. It includes a smartphone app that helps

customers position the equipment in the home to make it self-installable. It costs

$50 per month for Verizon customers and $70 otherwise and offers downlink speeds

of 300 Mb/s to 1 Gb/s. Verizon says the next step will be to allow 5G (i.e., cellular)

signals to be available in the home, using repeaters.  Common Networks, a company

founded by ex-Square employees, has designed a technology that can challenge providers

in the telecommunications market. For about $50 a month, Common Networks is offering

300 Mb/s too 1Gb/s download speeds for households around Silicon Valley. The company

uses unlicensed 5G microwave and millimeter-wave spectrum an antennas installed

on rooftops, and using open-source software and hardware, the company developed

so "graph-based technology" that delivers high-speed broadband for what it claims

is about one-tenth what telecom companies typically pay.

Common Networks, a company

founded by ex-Square employees, has designed a technology that can challenge providers

in the telecommunications market. For about $50 a month, Common Networks is offering

300 Mb/s too 1Gb/s download speeds for households around Silicon Valley. The company

uses unlicensed 5G microwave and millimeter-wave spectrum an antennas installed

on rooftops, and using open-source software and hardware, the company developed

so "graph-based technology" that delivers high-speed broadband for what it claims

is about one-tenth what telecom companies typically pay.  The FBI's Portland, OR,

office says home IoT devices like doorbells, digital assistants, and other devices

should be on a Wi-Fi network separate from computers. "Your fridge and your laptop

should not be on the same network," the office said in its weekly advice column.

"Keep your most private, sensitive data on a separate system from your other IoT

devices." Its good advice considering that IoT devices have dubious security features

now, and camera-enabled doorbells are being integrated into neighborhood networks

used by law enforcement. The reasoning behind it is simple. By keeping all the IoT

equipment on a separate network, any compromise of a "smart" device will not grant

an attacker a direct route to a user's primary devices -- where most of their data

is stored. Jumping across the two networks would require considerable effort from

the attacker. The easiest way is to use two routers. The same advice has been shared

in the past by IT and security experts.

The FBI's Portland, OR,

office says home IoT devices like doorbells, digital assistants, and other devices

should be on a Wi-Fi network separate from computers. "Your fridge and your laptop

should not be on the same network," the office said in its weekly advice column.

"Keep your most private, sensitive data on a separate system from your other IoT

devices." Its good advice considering that IoT devices have dubious security features

now, and camera-enabled doorbells are being integrated into neighborhood networks

used by law enforcement. The reasoning behind it is simple. By keeping all the IoT

equipment on a separate network, any compromise of a "smart" device will not grant

an attacker a direct route to a user's primary devices -- where most of their data

is stored. Jumping across the two networks would require considerable effort from

the attacker. The easiest way is to use two routers. The same advice has been shared

in the past by IT and security experts.  Major cable companies are

moving into the wireless business at a surprisingly rapid pace. In the third quarter

of this year alone, Comcast, Charter, and Altice added nearly 500,000 subscribers,

collectively reaching 2.5 million. MoffettNathanson analyst Craig Moffett noted

in a recent report that "as a percentage of net market growth, the cable operators

have already reached a level of clear relevance in wireless," and that cable is

now starting to "matter" in the wireless sector. He expects cable companies to add

nearly 2 million subscribers in 2020. Pricing is one of the reasons as Altice, for

example, is offering its current broadband subscribers at a rate of $20 per month

per line "for life" with unlimited voice, text, and data.

Major cable companies are

moving into the wireless business at a surprisingly rapid pace. In the third quarter

of this year alone, Comcast, Charter, and Altice added nearly 500,000 subscribers,

collectively reaching 2.5 million. MoffettNathanson analyst Craig Moffett noted

in a recent report that "as a percentage of net market growth, the cable operators

have already reached a level of clear relevance in wireless," and that cable is

now starting to "matter" in the wireless sector. He expects cable companies to add

nearly 2 million subscribers in 2020. Pricing is one of the reasons as Altice, for

example, is offering its current broadband subscribers at a rate of $20 per month

per line "for life" with unlimited voice, text, and data.